Why the author matters? Peter Thiel is a co-founder of Paypal and Palantir, one of the world’s largest data mining companies. He was also one of the early investors in Facebook, LinkedIn, Airbnb, Spotify and SpaceX. On top of being a well-known contrarian, the colorful billionaire is also gay, Christian and libertarian.

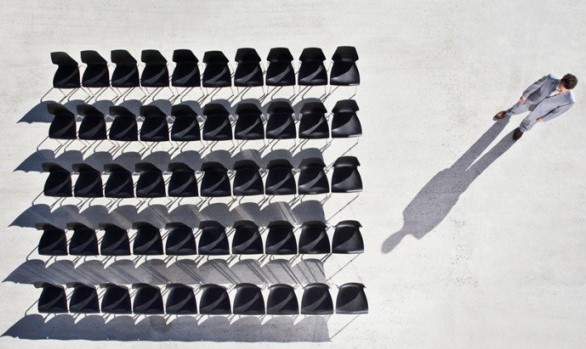

Going 0 to 1 (creating something new) is better than 1 to n (improving/scaling something that already exists)

In the preface, Thiel explains the meaning behind his book’s title. It’s in this opening that he prepares the readers for the most controversial claim in the book that competition is bad:

Every moment in business happens only once. The next Bill Gates will not build an operating system. The next Larry Page or Sergey Brin won’t make a search engine. And the next Mark Zuckerberg won’t create a social network. If you are copying these guys, you aren’t learning from them.

Of course, it’s easier to copy a model than to make something new. Doing what we already know how to do takes the world from 1 to n, adding more of something familiar. But every time we create something new, we go from 0 to 1. The act of creation is singular, as is the moment of creation, and the result is something fresh and strange.1Peter Thiel & Blake Masters, Zero to One: Notes on Startups, or How to Build the Future, (New York: The Crown Publishing Group, 2014), 1.

If you take one typewriter and build 100, you have made horizontal progress. If you have a typewriter and build a word processor, you have made vertical progress. 2Ibid, 7.

How to create a vision, how to get from Zero to One

Thiel asks his job interviewees a hard and tricky question: What important truth do very few people agree with you on? Popular but bad answers could be “education is broken,” or “God does not exist.” The best formula to respond is “most people believe in x, but the truth is the opposite of x.” The answer to the same in business context could hold the secret to the next great success:

The business version of our contrarian question is: what valuable company is nobody building? This question is harder than it looks, because your company could create a lot of value without becoming very valuable itself. 3Ibid, 24.

Monopoly is for winners, competition is for losers

For example, U.S. airline companies serve millions of passengers and create hundreds of billions of dollars of value each year. But in 2012, when the average airfare each way was $178, the airlines made only 37 cents per passenger trip. Compare them to Google, which creates less value but captures far more. Google brought in $50 billion in 2012 (versus $160 billion for the airlines), but it kept 21% of those revenues as profits—more than 100 times the airline industry’s profit margin that year. Google makes so much money that it’s now worth three times more than every U.S. airline combined.

The airlines compete with each other, but Google stands alone. Economists use two simplified models to explain the difference: perfect competition and monopoly. 4Ibid.

In the real world outside economic theory, every business is successful exactly to the extent that it does something others cannot. Monopoly is therefore not a pathology or an exception. Monopoly is the condition of every successful business.

Tolstoy opens Anna Karenina by observing: “All happy families are alike; each unhappy family is unhappy in its own way.” Business is the opposite. All happy companies are different: each one earns a monopoly by solving a unique problem. All failed companies are the same: they failed to escape competition. 5Ibid, 34.

Avoid competition or “market disruption,” just focus on your vision

“Disruptive innovation” was coined by Clayton Christensen in 1995. For more than two decades, since the publication of his book The Innovator’s Dilemma (1997), it was considered the ultimate goal of a successful enterprise to “disrupt” an existing market by introducing new products like Uber, Airbnb or Netflix. Thiel challenges that widely-accepted gospel and states that entrepreneurs should focus on building new products, thereby creating new markets that never existed.

PayPal could be seen as disruptive, but we didn’t try to directly challenge any large competitor.It’s true that we took some business away from Visa when we popularized internet payments: you might use PayPal to buy something online instead of using your Visa card to buy it in a store. But since we expanded the market for payments overall, we gave Visa far more business than we took. The overall dynamic was net positive, unlike Napster’s negative-sum struggle with the U.S. recording industry. As you craft a plan to expand to adjacent markets, don’t disrupt: avoid competition as much as possible. 6Ibid, 57.

Perfect competition: “in the long run no company makes an economic profit”

“Perfect competition” is considered both the ideal and the default state in Economics 101. So-called perfectly competitive markets achieve equilibrium when producer supply meets consumer demand. Every firm in a competitive market is undifferentiated and sells the same homogeneous products. Since no firm has any market power, they must all sell at whatever price the market determines. If there is money to be made, new firms will enter the market, increase supply, drive prices down, and thereby eliminate the profits that attracted them in the first place. If too many firms enter the market, they’ll suffer losses, some will fold, and prices will rise back to sustainable levels. Under perfect competition, in the long run no company makes an economic profit.

The opposite of perfect competition is monopoly. Whereas a competitive firm must sell at the market price, a monopoly owns its market, so it can set its own prices. Since it has no competition, it produces at the quantity and price combination that maximizes its profits. 7Ibid, 24.

Why economists view competition as an ideal state?

It’s a relic of history. Economists copied their mathematics from the work of 19th-century physicists: they see individuals and businesses as interchangeable atoms, not as unique creators. Their theories describe an equilibrium state of perfect competition because that’s what’s easy to model, not because it represents the best of business. But it’s worth recalling that the long-run equilibrium predicted by 19th-century physics was a state in which all energy is evenly distributed and everything comes to rest—also known as the heat death of the universe. Whatever your views on thermodynamics, it’s a powerful metaphor: in business, equilibrium means stasis, and stasis means death. If your industry is in a competitive equilibrium, the death of your business won’t matter to the world; some other undifferentiated competitor will always be ready to take your place. 8Ibid, 34.

Competition is a dangerous ideology

Creative monopoly means new products that benefit everybody and sustainable profits for the creator.Competition means no profits for anybody, no meaningful differentiation, and a struggle for survival. So why do people believe that competition is healthy? The answer is that competition is not just an economic concept or a simple inconvenience that individuals and companies must deal with in the marketplace. More than anything else, competition is an ideology—the ideology—that pervades our society and distorts our thinking. We preach competition, internalize its necessity, and enact its commandments; and as a result, we trap ourselves within it—even though the more we compete, the less we gain. 9Ibid, 35.

Capitalism and competition are opposites

Americans mythologize competition and credit it with saving us from socialist bread lines. Actually, capitalism and competition are opposites. Capitalism is premised on the accumulation of capital, but under perfect competition all profits get competed away. The lesson for entrepreneurs is clear: if you want to create and capture lasting value, don’t build an undifferentiated commodity business.10Ibid, 25.

Between good monopolies and bad monopolies

To an economist, every monopoly looks the same, whether it deviously eliminates rivals, secures a license from the state, or innovates its way to the top. In this book, we’re not interested in illegal bullies or government favorites: by “monopoly,” we mean the kind of company that’s so good at what it does that no other firm can offer a close substitute. Google is a good example of a company that went from 0 to 1: it hasn’t competed in search since the early 2000s, when it definitively distanced itself from Microsoft and Yahoo! 11Ibid, 25.

Monopoly is good for progress and innovation

So, a monopoly is good for everyone on the inside, but what about everyone on the outside? Do outsized profits come at the expense of the rest of society? Actually, yes: profits come out of customers’ wallets, and monopolies deserve their bad reputation—but only in a world where nothing changes.

In a static world, a monopolist is just a rent collector. If you corner the market for something, you can jack up the price; others will have no choice but to buy from you. Think of the famous board game: deeds are shuffled around from player to player, but the board never changes. There’s no way to win by inventing a better kind of real estate development. The relative values of the properties are fixed for all time, so all you can do is try to buy them up.

But the world we live in is dynamic: it’s possible to invent new and better things. Creative monopolists give customers more choices by adding entirely new categories of abundance to the world. Creative monopolies aren’t just good for the rest of society; they’re powerful engines for making it better.

Even the government knows this: that’s why one of its departments works hard to create monopolies (by granting patents to new inventions) even though another part hunts them down (by prosecuting antitrust cases). It’s possible to question whether anyone should really be awarded a legally enforceable monopoly simply for having been the first to think of something like a mobile software design. But it’s clear that something like Apple’s monopoly profits from designing, producing, and marketing the iPhone were the reward for creating greater abundance, not artificial scarcity: customers were happy to finally have the choice of paying high prices to get a smartphone that actually works.

The dynamism of new monopolies itself explains why old monopolies don’t strangle innovation. With Apple’s iOS at the forefront, the rise of mobile computing has dramatically reduced Microsoft’s decades-long operating system dominance. Before that, IBM’s hardware monopoly of the ’60s and ’70s was overtaken by Microsoft’s software monopoly. AT&T had a monopoly on telephone service for most of the 20th century, but now anyone can get a cheap cell phone plan from any number of providers. If the tendency of monopoly businesses were to hold back progress, they would be dangerous and we’d be right to oppose them. But the history of progress is a history of better monopoly businesses replacing incumbents.

Monopolies drive progress because the promise of years or even decades of monopoly profits provides a powerful incentive to innovate. Then monopolies can keep innovating because profits enable them to make the long-term plans and to finance the ambitious research projects that firms locked in competition can’t dream of. 12Ibid, 32-34.

How monopolists should disguise their monopoly

Non-monopolists brag about the fact that they are unique, exaggerate their own distinction by defining their market in the narrowest terms possible. For example, the best pizzeria in the neighborhood. Monopolists do the opposite:

Monopolists lie to protect themselves. They know that bragging about their great monopoly invites being audited, scrutinized, and attacked. Since they very much want their monopoly profits to continue unmolested, they tend to do whatever they can to conceal their monopoly—usually by exaggerating the power of their (nonexistent) competition.

Think about how Google talks about its business. It certainly doesn’t claim to be a monopoly. But is it one? Well, it depends: a monopoly in what? Let’s say that Google is primarily a search engine. As of May 2014, it owns about 68% of the search market. (Its closest competitors, Microsoft and Yahoo!, have about 19% and 10%, respectively.) If that doesn’t seem dominant enough, consider the fact that the word “google” is now an official entry in the Oxford English Dictionary—as a verb. Don’t hold your breath waiting for that to happen to Bing.

But suppose we say that Google is primarily an advertising company. That changes things. The U.S.search engine advertising market is $17 billion annually. Online advertising is $37 billion annually. The entire U.S. advertising market is $150 billion. And global advertising is a $495 billion market. So even if Google completely monopolized U.S. search engine advertising, it would own just 3.4% of the global advertising market. From this angle, Google looks like a small player in a competitive world.

What if we frame Google as a multifaceted technology company instead? This seems reasonable enough; in addition to its search engine, Google makes dozens of other software products, not to mention robotic cars, Android phones, and wearable computers. But 95% of Google’s revenue comes from search advertising; its other products generated just $2.35 billion in 2012, and its consumer tech products a mere fraction of that. Since consumer tech is a $964 billion market globally, Google owns less than 0.24% of it—a far cry from relevance, let alone monopoly. Framing itself as just another tech company allows Google to escape all sorts of unwanted attention. 13Ibid, 26-27.

Consider a statement from Google chairman Eric Schmidt’s testimony at a 2011 congressional hearing:

We face an extremely competitive landscape in which consumers have a multitude of options to access information.

Or, translated from PR-speak to plain English:

Google is a small fish in a big pond. We could be swallowed whole at any time. We are not the monopoly that the government is looking for. 14Ibid, 30.

You might also like:

Is Peter Thiel correct that monopoly is good and competition is for losers?

Are monopolies good for business and society?

BOOK: ZERO TO ONE

When wealthy conservative men tell you higher education is worthless

What’s behind that alarming trend and ten reasons why they’re wrong

BOOK: ZERO TO ONE

Endnotes